tax shelter real estate definition

Ad Prepare for Real Estate Tax - Shelter Techniques by Kusnet Jack. A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance.

Navigating The Real Estate Professional Rules

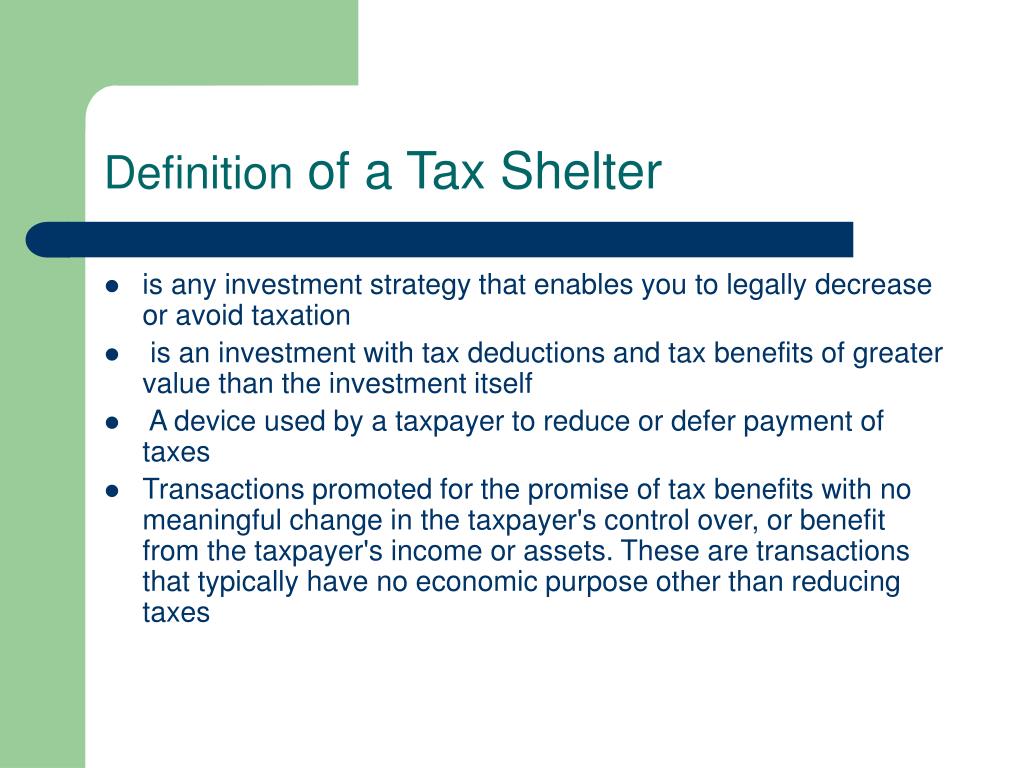

The phrase tax shelter is.

. Tax Shelter A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest insurance. Tax Shelter Law and Legal Definition A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

461 i 3 provides that the term tax shelter means. It is a legal way for individuals to. Ad Join investors on one of the largest online crowdfunding real estate investing platforms.

Fast Reliable Answers. Ad Leading Federal Tax Law Reference Guide. For a married couple filing jointly with a taxable income of 280000 and capital gains of.

If your taxable income is 496600 or more the capital gains rate increases to 20. The term can also refer to a legal entity created for the purpose of tax avoidance. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments.

An investment that shields items of income or gain from payment of. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. Tax shelters are ways individuals and corporations reduce their tax liability.

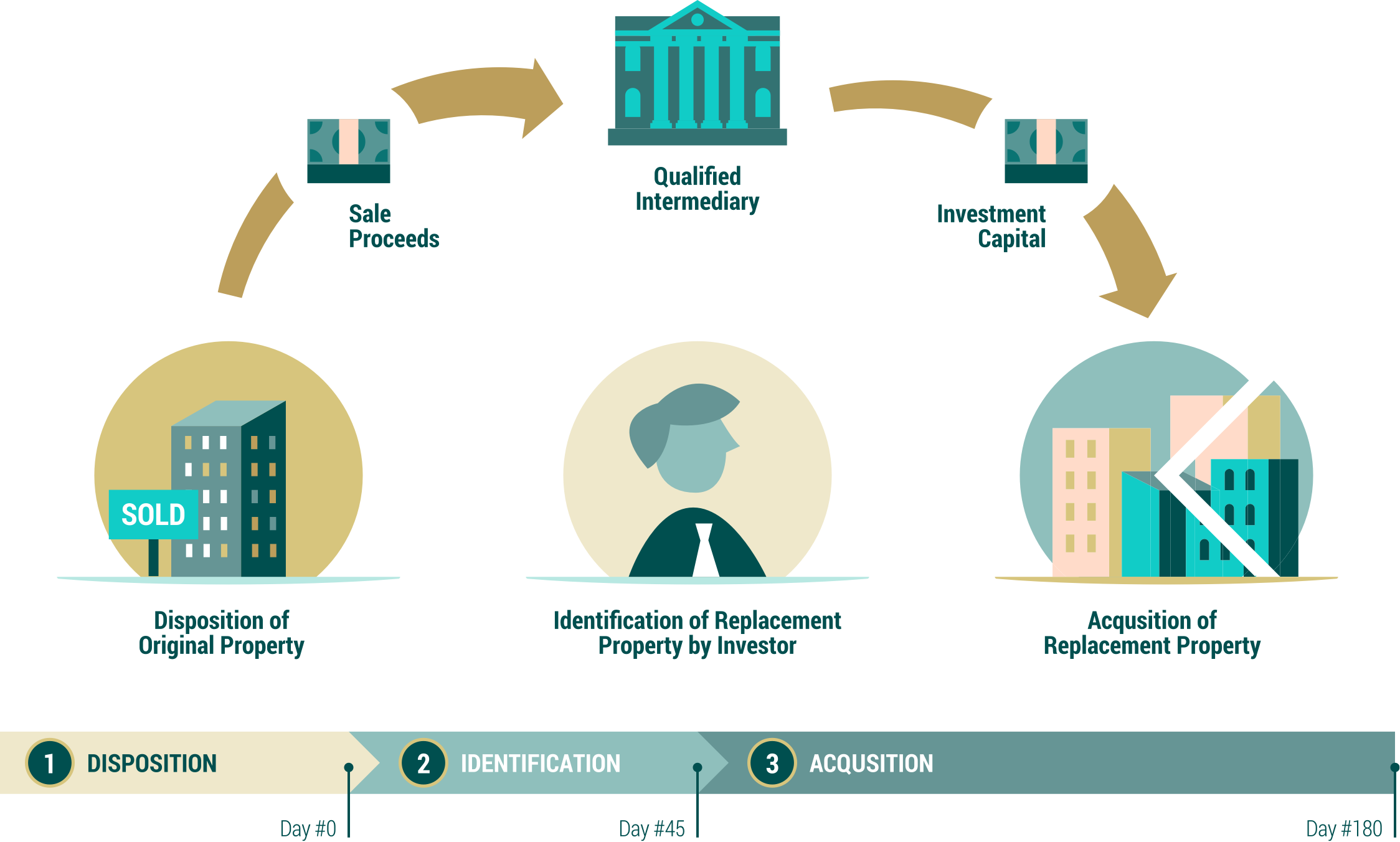

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year. Since 1979 as shown in Figure 13 personal. Ad If youre selling stock real estate or a business youve got a 180 day window to act.

Number of Inherited Properties Likely to Grow. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

Any enterprise other than a C corporation if at any time interests in such enterprise have been offered for sale in. Experienced in-house construction and development managers. The term tax shelter means.

A term used to describe some tax advantages of owning real property or other investments. A tax shelter is an investment or arrangement designed to minimize or defer taxes. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any.

Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. Despite being linked to the volatile real estate market the property tax is Californias most stable major revenue source. Ad If youre selling stock real estate or a business youve got a 180 day window to act.

The methodology can vary. Experienced in-house construction and development managers. Real Estate Glossary Term Tax Shelter.

For The Wealthiest A Private Tax System That Saves Them Billions The New York Times

Understanding Commercial Real Estate Depreciation Than Merrill

Klr Is Your Business A Tax Shelter You Might Be Surprised

Tax Shelters For Real Estate Investors Morris Invest

What Is A Tax Shelter Smartasset

What Is A Tax Shelter And How Does It Work

Ppt Tax Shelter Powerpoint Presentation Free Download Id 69636

Passive Income Tax Rate What Investors Should Know 2022

What Is A Tax Shelter Smartasset

Estate Taxes Will The Stepped Up Basis Be Eliminated Bankrate

Quirks In A U S Treaty With Malta Turn Into A Tax Play Wsj

Using Real Estate As A Tax Shelter Mashvisor

9 Facts About Pass Through Businesses

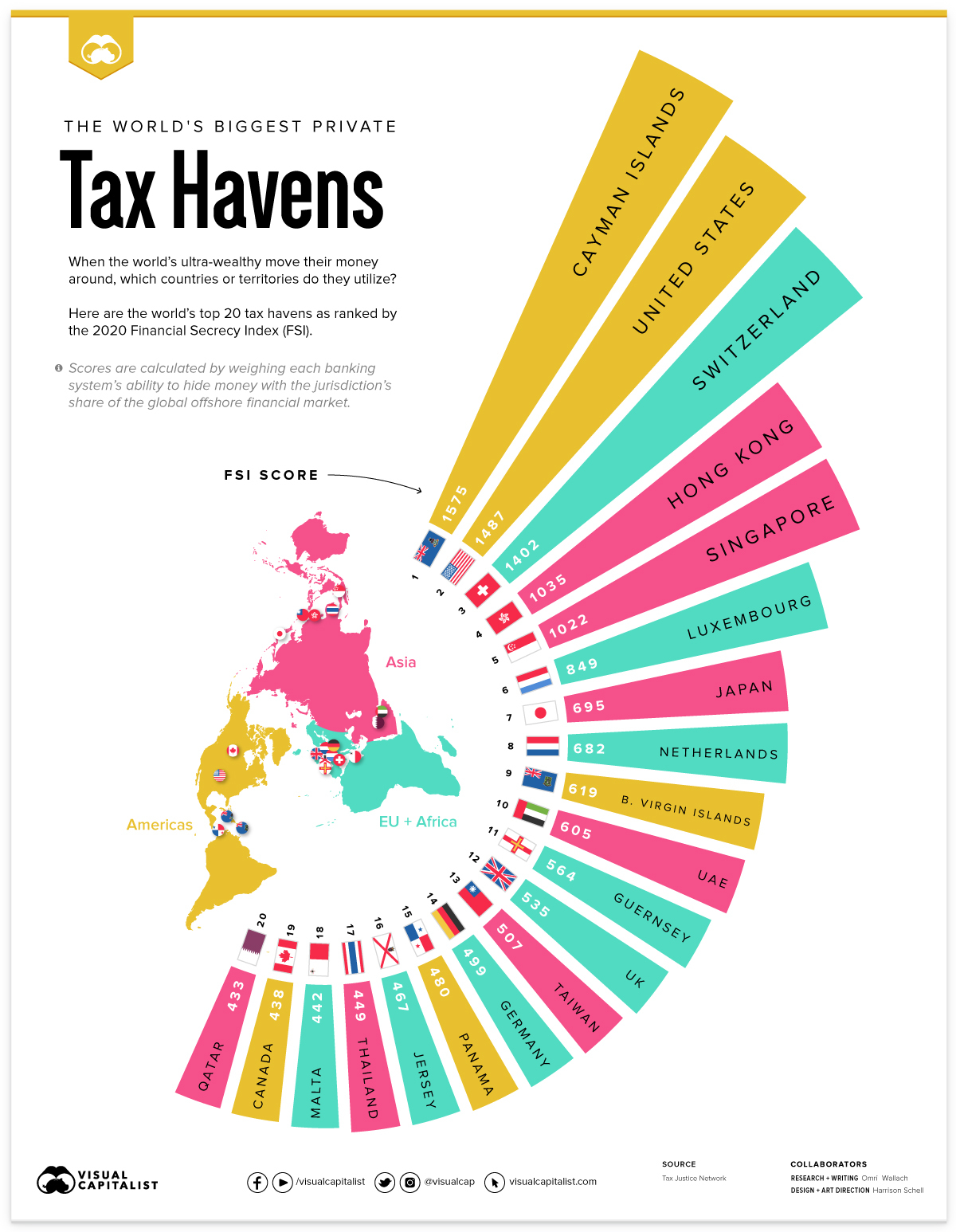

Mapped The World S Biggest Private Tax Havens In 2021

The 721 Exchange Or Upreit A Simple Introduction

Tax Benefits And Limitations Of Real Estate Investments

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen